All You Need To Know About Real Estate Counteroffers

Dec 21, 2023 By Susan Kelly

Introduction

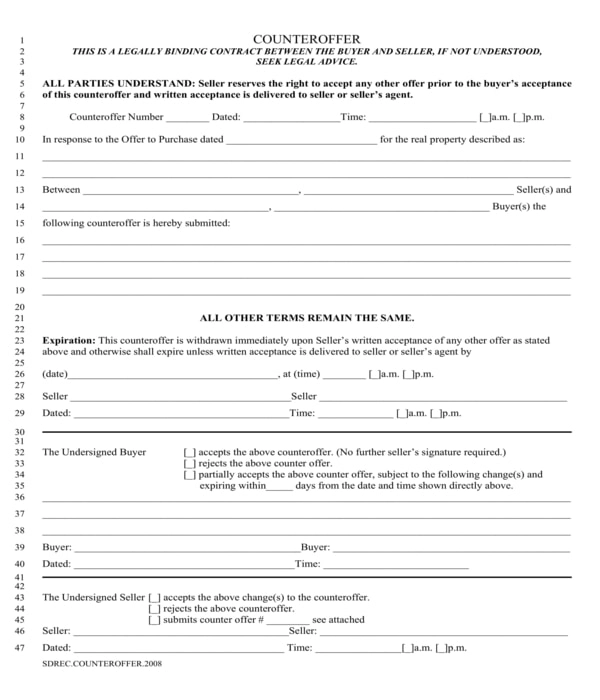

In a perfect world, all it would take to close on a home is to make a great offer, have the seller accept it, and sign the contract. But since we don't live in a perfect world, when a homebuyer or seller makes an offer, you can accept it, reject it, or make a counteroffer. A counteroffer is usually the best course of action in real estate negotiations because compromise is at the very core of the industry. Though tempting, making a counteroffer can be difficult, and the process could drag on for months. Mastering the real estate counteroffer is essential to closing a deal on favourable terms.

Why Would You Need To Counteroffer?

- The first step in a real estate transaction is the seller setting an asking price. Buyers will then make an opening bid on the home, often below the asking price. The seller can now choose to accept the offer or counter offer.

- Several variables influence whether or not a buyer will receive a counteroffer. Among these is the time the home has been on the market, the asking price, and whether or not your offer is competitive with the sellers'.

- The seller has the option of accepting the offer as is, rejecting the offer, or making a counteroffer in an attempt to bring the two prices closer together.

- Between the time of the initial purchase agreement and the closing date, counteroffers are possible.

- The buyer and the seller legally commit to the contract's terms once they sign it. A lot can change between when an offer (or counteroffer) is signed and the closing date.

- It's possible for there to be more counteroffers before the deal finally closes. Disputes frequently arise when inspections reveal unexpected information, when the appraisal is too low, or when the provisions of the purchase agreement aren't adhered to.

- Each party to a contract is responsible for carrying out its end of the bargain. The buyer, for instance, might need to arrange finance. Also, the seller must comply with all inspection requests and make all agreed-upon repairs.

How Many Counteroffers Are Typical?

A house advertised at $415,000 received five offers over the asking price. The buyer's initial bid was a lowball of $400,000, which was rejected. To sum up the outcome:

- As a first counteroffer, the seller proposes an increase to the purchase price of $412,000. They're also cool with it in the washer and dryer as-is.

- First Counteroffer by Buyer (to Seller): $405k. They accept the washer and dryer "as is" and without warranty.

- The second counteroffer from the seller is a sales price reduction to $409,900 (this is addressed to the buyer). To make up for the decreased sales price, they do not include the washer and dryer in the sale.

- The second counteroffer from the buyer states that the total sales price will be $407,500. They are fine without the laundry facilities being provided.

- Third Seller Counteroffer to Buyer: Seller will sell for $407,500. The sale does not include the refrigerator, washing machine, or dryer.

When Do I Make A Real Estate Counteroffer?

As A Seller

If a buyer makes an offer that doesn't quite meet your needs but is still interested in working with them, you can always make a counteroffer. Let's pretend you sell your home for $300,000, and an interested buyer offers you $275,000. You could decline the buyer's offer and keep looking for another buyer who will pay more. You may even try your hand at some negotiation.

As A Buyer

You can make a counteroffer if you want to purchase a home, but the asking price is too high, or you don't think the house is worth the price. Returning to our scenario, let's imagine the seller is asking $300,000 for a home that you value at $275,000. If the seller responds with $285,000, you may offer $280,000.

Pros Of A Counter Offer

Making a counteroffer can increase your chances of getting a better deal. If your proposed alternate schedule is approved, you'll be free to make it work for you. A future counteroffer can be an option to save the contract if new information emerges regarding the house or if certain conditions of the agreement are not met.

Cons Of A Counter Offer

You'll forfeit the property sale or buy if you don't pay on time. Your counteroffer is met with still another counteroffer, this time with even less favourable terms. While the seller is considering your counteroffer, they may receive a higher offer from another buyer.

Conclusion

If the house seller is unhappy with the offer made by the buyer, they may choose to make a counter offer. Some common elements of counteroffers include adjusting the price or increasing the amount of the earnest money deposit. If a bidder rejects a seller's counteroffer, they can make a new offer that rejects the seller's counteroffer. The sellers may accept, reject, or counter a bid depending on the situation.

What Is The Average Cost to Paint a House in 2023: An Overview

Where to Get Free Credit Scores

What Is The Difference Between A Checking And A Savings Account?

What You Should Know About Mistakes In Debt Consolidation

Understanding Accretive: Definition and Real-world Examples in Business and Finance

Should You Consider A HELOC On Your Investment Property?

How Do You Get an Income Share Agreement for College: Your Complete Guide

How to Create a Facebook Business Page: Easy 6-Step Guide

Should You Live with Parents to Save Money?