Where to Get Free Credit Scores

Dec 21, 2023 By Triston Martin

The most popular CRBs, that is, TransUnion, Equifax, and Experian, offer yearly free credit reports. They are required by law to provide these reports without being forced to do so, in any way. These are just credit reports. When it comes to free credit scores, that is an entirely different story; it is a paid service.

Credit scores are essential data that lenders use to decide one’s creditworthiness. These all-important digits in the financial world should be accurate and objective. They work similarly to school grades.

Here are some of the best sources to get your free personalized credit score:

NerdWallet

NerdWallet provides free credit scores to its clients. It also provides the legally required free credit reports. Some of the other services it provides include credit monitoring, information tools, and other general offers. The best part is that they do not require your card details to provide you with the free credit score service. You do not need to provide your credit card details to access your credit score. NerdWallet earns income through affiliates.

It uses the VantageScore 3.0 ® model and gets its data from TransUnion. Their data is accurate and objective, which means a lot when analyzing data to obtain credit scores.

One is advised to check their credit scores continually, and after specific periods, just to assess their credit status. Sites like NerdWallet check your credit history through what is called a soft inquiry, which guarantees no effect on your general credit score.

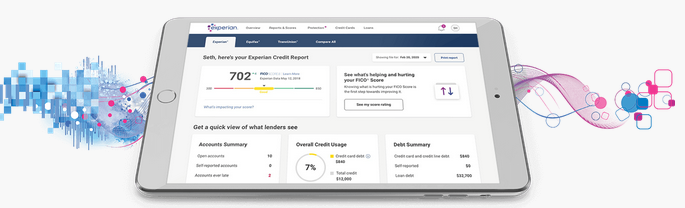

The Experian FICO® Score 8 (scoring model)

Experian offers extra services to its clients through free credit scores and the obviously required by law free credit report. It uses the FICO® Score 8 model. As a rule of thumb, it is best to consider different models because employers will not always use Experian’s preferred one.

Credit Karma

Credit Karma provides essential insights into one’s credit history, credit monitoring services, and recommendations on the best decisions to improve your credit score.

Their free credit score report can be accessed here.

Credit Karma gets data from Equifax and TransUnion, so you are assured of an accurate score with these two credit giants. Equifax sources its data from numerous factors, such as past credit history, installment loans, personal statements, and many more, which provide analysts at Credit Karma with the much-needed detail to calculate the perfect score.

The big question is why Credit Karma offers free credit scores instead of selling them to consumers. The catch is that Credit Karma makes money from selling other services and affiliate marketing. They get paid a commission for any services they have sold to you through their website.

Credit Karma uses the VantageScore model, different from the more mainstream FICO® model. While most lenders commonly use the latter, it does not disparage the effectiveness of the former. Other models should be used together to make crucial credit decisions.

VantageScore 3.0 Credit Score Model

Since Credit Karma uses this scoring model to provide scores and reports to creditors, it is prudent to understand their scoring range.

781-850 – Excellent

661-780 – Good

601-660 – Fair

300-600 – Poor

Further, this score is affected by the following factors:

- Credit utilization rate. According to this scale, you should use less than 30% of your credit.

- Payment history. Of course, just like all scoring models, one’s commitment to paying their loans on time, in time, or the way in advance is reflected in their credit history, which highly affects their credit score.

- Type and age of credit. An assortment of credit accounts is a plus.

- Balances. This does not take into consideration the percentage but the cash total that is, in dollars.

Credit Sesame

Credit Sesame has a pop-up for website visitors that allows them to get their free credit score. It prides itself in providing free daily credit scores in seconds plus offering advice on the best next course of action.

With over 17 million users having received their free credit score, Credit Sesame assures its client of accurate scores within less than 90 seconds. They do not require a credit card to sign up and receive your credit score.

It also provides its clients with a free credit builder to help them improve their credit scores. This could help them save thousands of dollars in purchasing a car or a mortgage.

You will have to sign up or sign in if you already have an account. The only requirement for signing up is your email address and a strong password.

CreditWise

CreditWise uses the same scoring model that Credit Karma uses: the VantageScore ® 3.0 credit score. It also gets its data from TransUnion. The information is synced together so that any changes from your TransUnion report get automatically updated to your CreditWise credit score.

Even better, CreditWise provides clients with an online simulator to calculate their credit score if you change some factors that affect it. For instance, it calculates your new credit score if you pay off a certain amount of debt (not predetermined; you input the amount yourself).

How often should you check your credit score?

First, it is important to understand that your credit score is not a life-or-death situation. It should not entirely define your credit history but act as an indicator of your credit health. Now that that’s out of the way, there is no limit to the number of times you can check your credit score. That is why it is offered for free by these sites.

The frequency within which you receive your score does not affect your credit report—knowing your credit score to make better credit choices consistently would be better. Like the school grades analogy we used above, your credit score does not define you but motivates you to work better next time or pat yourself on the back for achieving your goals.

Regardless of which credit scoring model you use, whether it is FICO® or VantageScore®, your credit score reflects your credit health. What you see is what lenders will see. The best way forward is to enlist the services of a credit score builder, or make actionable, positive steps towards increasing your credit score.

Social Security Benefits

What Is The Difference Between A Checking And A Savings Account?

How to Refinance Your House - A Comprehensive Guide

Is PayPal a Secure Method of Payment?

Review of Country Insurance's homeowner plan

What Is An Interest-Only Loan: A Complete Understanding

What Is the Difference Between Stocks and Index Funds: A Quick Overview

Understanding Non-Deductible IRAs: Essential Insights

How Do You Get an Income Share Agreement for College: Your Complete Guide